Let’s Talk Bubble

Is NVDIA the New JDSU

Make no mistake here, what is going on in the world of Artificial Intelligence (AI) is a bubble. Even if we somehow knew this with 100% certainty, it tells us absolutely nothing about what to do about it. Bubbles have always had a way of going up a lot more than any reasonable expectations. I think this is because those smart enough to understand how overvalued stuff gets in a bubble get short, and then they get squeezed forcing prices even higher. Think GameStop, only with real fundamentals behind it.

The first market I ever traded was Hong Kong, when the Hang Seng Index (HSI) and went from ~$2,500 in 1989 to ~$12,000 in 1994. The “smart” money at the time started calling it a full-fledged bubble somewhere around the $7,000 to $8,000 level. Like all bubbles, there was a perfectly good reason behind it. In that case, China was about to open up and go from a non-player in the global economy to a major player. This did in fact happen. While the HSI fell from $12,000 to $8,000 in the next two years, it did go on to make new highs over the next three years but was trading at about 8,000 ten years later. Again, while the index made new all-time highs again in 2000, 2007 and 2018, it currently trades about 25% higher than the level in 1994… 30 Years later. To me this means that even if you pegged the high in the “bubble” you did not make much money being short unless you were very adept at covering shorts. Not an easy thing to do when you are bearish.

The more famous bubble of course was the internet stock bubble of the late 1990s. I would pick the start date of this bubble as Netscape IPO day, which was on August 9, 1995. At that time the Nasdaq index was around $2,000. By March 2000 it was at ~$5,000. From my recollection, the bubble callers came in somewhere around $3,500 - $4,000. This one was also based on the correct assumption that this new technology, the internet, was going to change the world. The poster child stock for this bubble was JDSU (now VIAV). In August 1995, JDSU stock was around $5. By June 1998, it was trading over $37. This is a gain of over six times. Over the next three months it dropped about 50%. Then from October 1998 to March of 2000 the stock went from ~$20 to ~$635. This is a thirty bagger in about 17 months.

Just for fun, let’s compare JDSU to this market’s poster child, Nvidia. We can say the AI thing started early last year. Nvidia, even from its low of $110, has now gone up almost six times that level. So, if we are going to argue this is the start of the AI bubble, we can say there is a way to go.

Now in fairness there are some differences here. JDSU started at $5. Nvidia had already gone up from $5 to $300 from 2015 to 2019 before dropping about 60% during the 2022 bear market. So, the total move is actually like what JDSU did from low to high.

So, which one is it? Is Nvidia about to go up thirty times or has it already done that? Of course, I have no way of knowing. I am just trying to point out here that price moves in a bubble can be absolutely astonishing and trying to pick the top of the bubble again and again can be extremely dangerous. What I do know is that I have heard more stories in the past year about traders that have lost a lot of money trying to short Nvidia than I have heard stories about traders that are getting rich off this move. This is much different than the previous two bubbles I mentioned where I only heard about how rich everyone was getting so quickly. So many people are still around that remember the 2000 bubble, and many more who got burned in the 2022 bear market, that there seems a hesitancy to be a bag holder this time around.

CMR COT Charts and Commentary

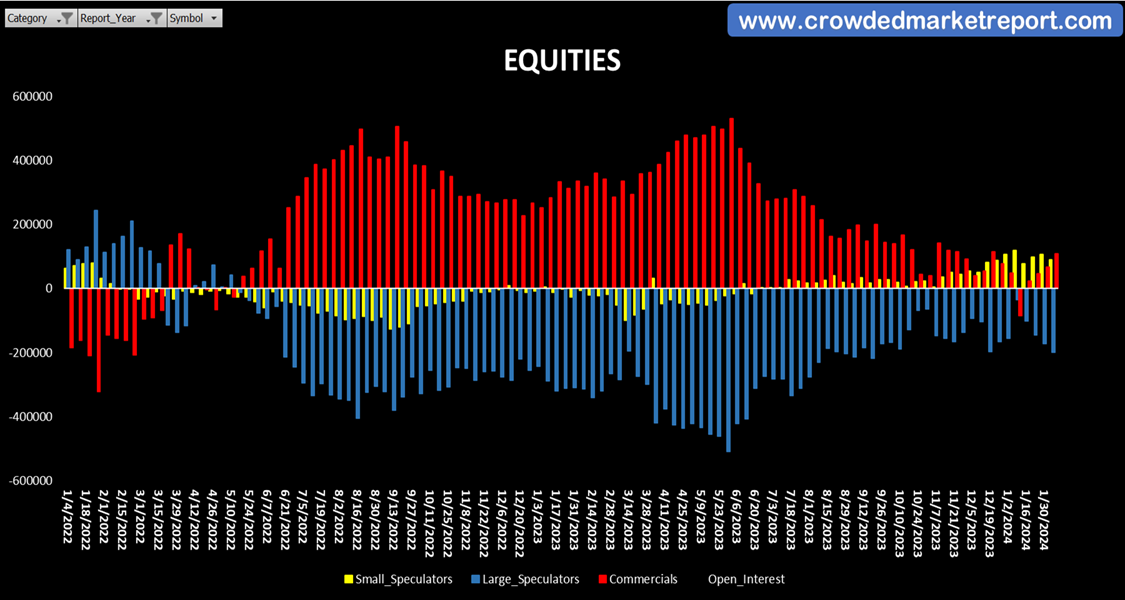

This positioning is straight up insane with the stock market on all-time highs. Large Speculators (blue column) increased their net-short positioning week over week right before the markets continued higher reaching new records by the end of the week. Small Speculators did the same, even though they remain net-long, they covered some of those longs and were sellers last week.

If you are interested in learning more about CMR we are offering our first SubStack promotion as a thank you for the support so far this year. So if you have made it this far and want to join our community, receive the weekly report, weekly chart, weekly index, private Discord, weekly Zoom Q&A calls with Jason, you can use the following codes:

Substack1 to take off $50 from your initial monthly payment, or

Substack3 to take off $75 from your initial quarterly payment, or

Substack12 to take off $100 from your initial yearly payment.

Each code will be limited. If you use the code and it does not work, please email crowdedmarketreport@gmail.com for support.

Thanks,

CMR Team on behalf of Jason Shapiro

Don’t Trade, Fade

p.s. if you have not watched Jason’s latest interview with US Investing Champ and full-time Trader Oliver Kell, it is a must watch for anyone wanting to learn more about what it takes to trade full-time.

Thanks for sharing the wisdom . Much appreciated

Amazing !!