CMR Chart of the Week - Nasdaq

Is the Rally Over for 2024

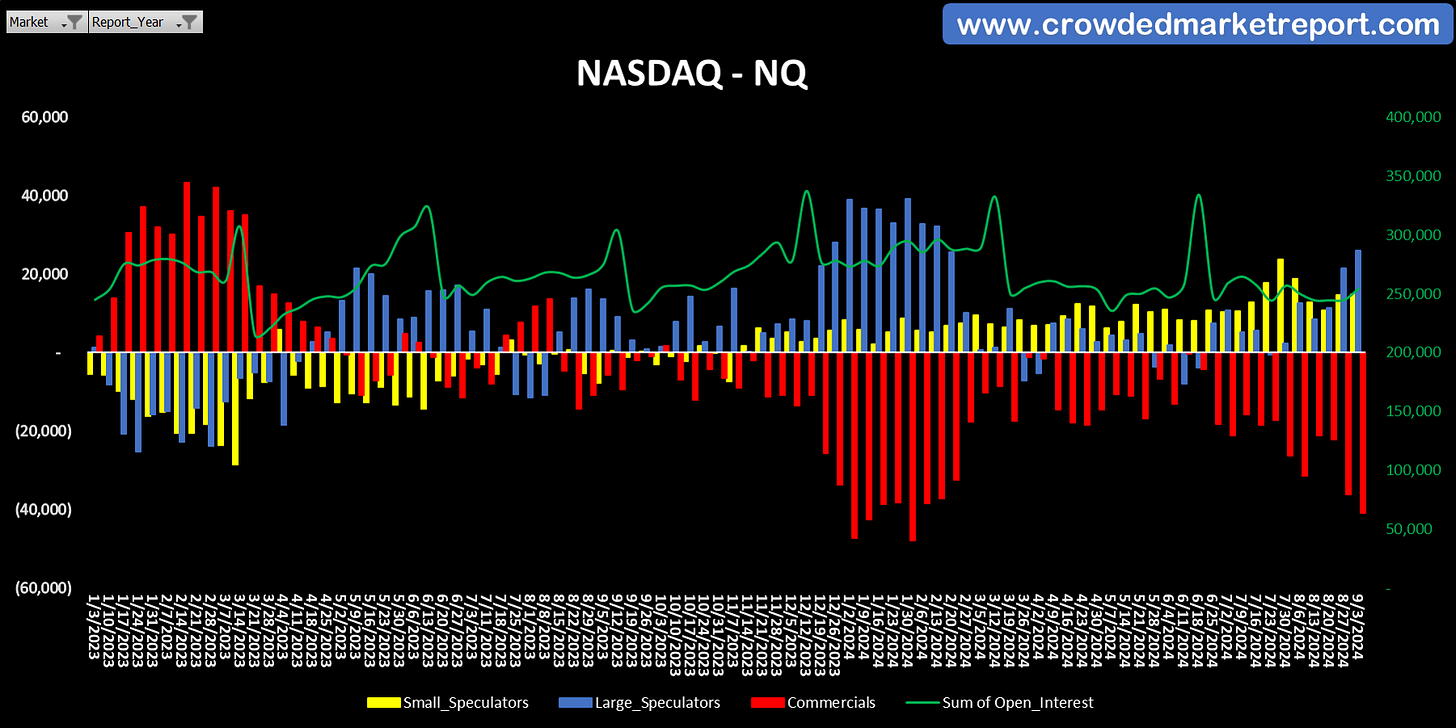

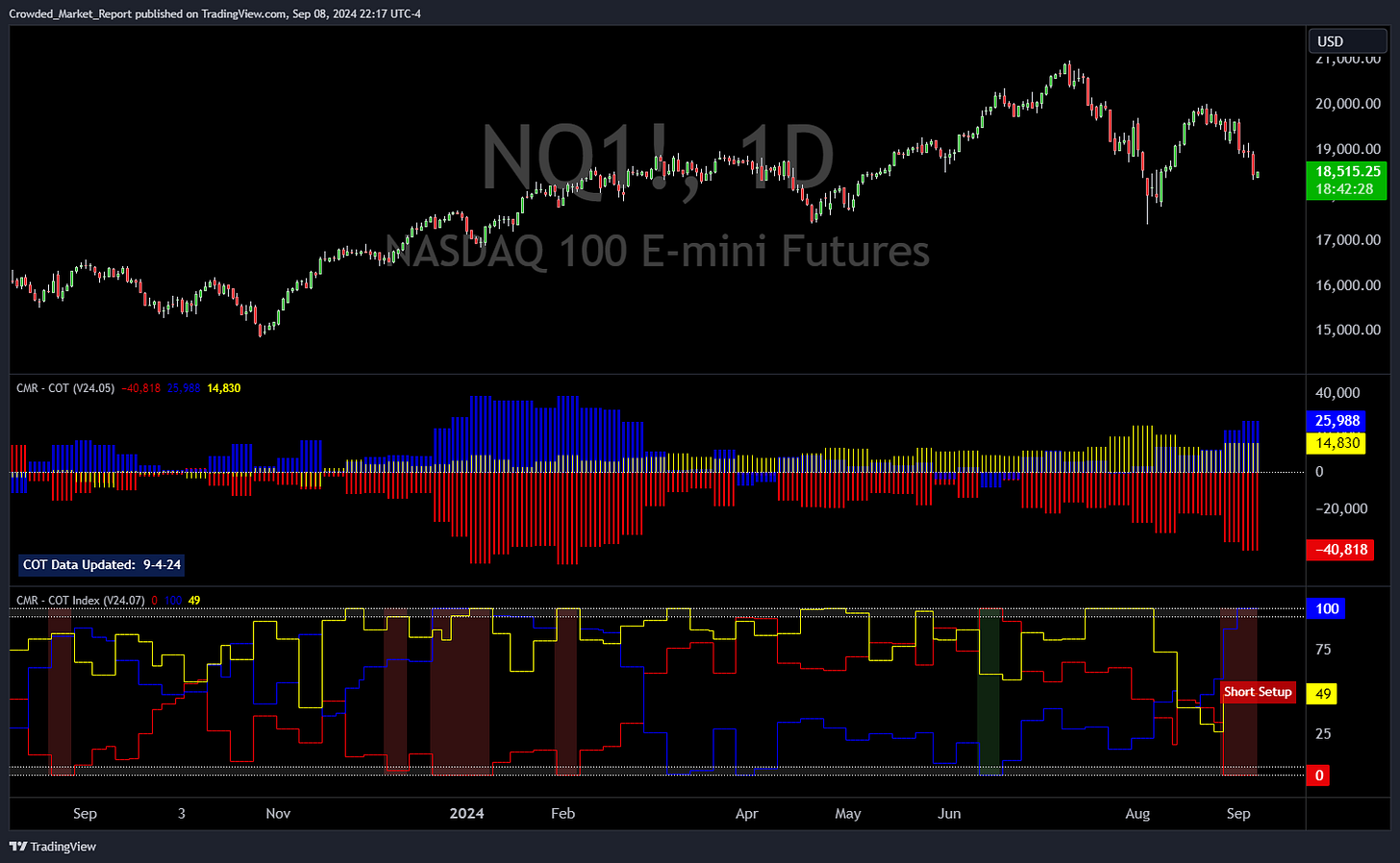

A few weeks back we highlighted that Speculators were starting to buy the dip and have now committed to buying the Nasdaq aggressively. The Nasdaq has been the worst performing index the last month and has lead the market correction down. With the Fed rate cut decision next week, does the stock market have any fuel left to make new highs in 2024, or did we top already. Especially when you look at the potential news failure in August when NVIDIA reported bullish earnings and it failed to close green, and so did the Nasdaq. Proceed with caution…

Hope you enjoyed today’s post. If you are interested in learning more about the Crowded Market Report and the services we provide, which includes more in depth analysis of all major markets including Equities, Currencies, Crypto, Fixed Income, Precious Metals, Industrial Metals, Softs, Grains and more, please visit www.crowdedmarketreport.com.

To learn more about Crowded Market Report, you can visit the links below and for a limited time we are offering 10% off any membership by simply using code substack10 during checkout.

Thanks,

Jason Shapiro & The CMR Team

CMR Publishing LLC is a content provider and publisher and is not a registered broker-dealer. By accessing Crowded Market Report websites and/or using Crowded Market Report products and services, including without limitation Substack and any and all content available on or through the Service and via email, you understand and agree that the material provided in CMR Publishing LLC dba Crowded Market Report products and services is for informational and educational purposes only, and that no mention of a particular security in any Crowded Market Report product or service constitutes a recommendation to buy, sell, or hold that or any other security, or that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. This content is for educational purposes only.

Good one - Vanda had one that showed retail jumped into the August lows with two hands compared to just the opposite behavior on every other correction in this bull market since 2022. That's the behavior that we don't want to see if we are bullish. Clean their clocks please.