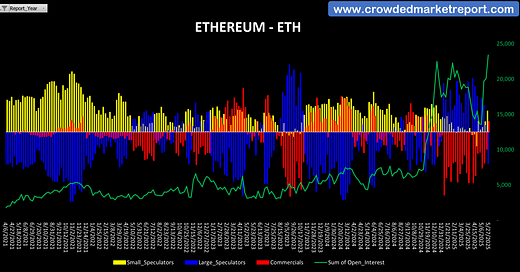

Last week, we posted about Bitcoin and how Large Speculators continue to be on the wrong side of every rally to new all-time highs in the currency for the past 18 months. It appears Large Speculators are following suit in ETH and doing so at levels not seen before in ETH futures since inception. As you can see from the first CMR COT chart, Large Speculators became net-short last week in a significant way. They also did so at the highest level of Open Interest (green line, values on right axis) we have seen in the entire history of this contract. Now, OI usually does not impact trading decision for the CMR process, but when you extreme levels like this, it is worth mentioning.

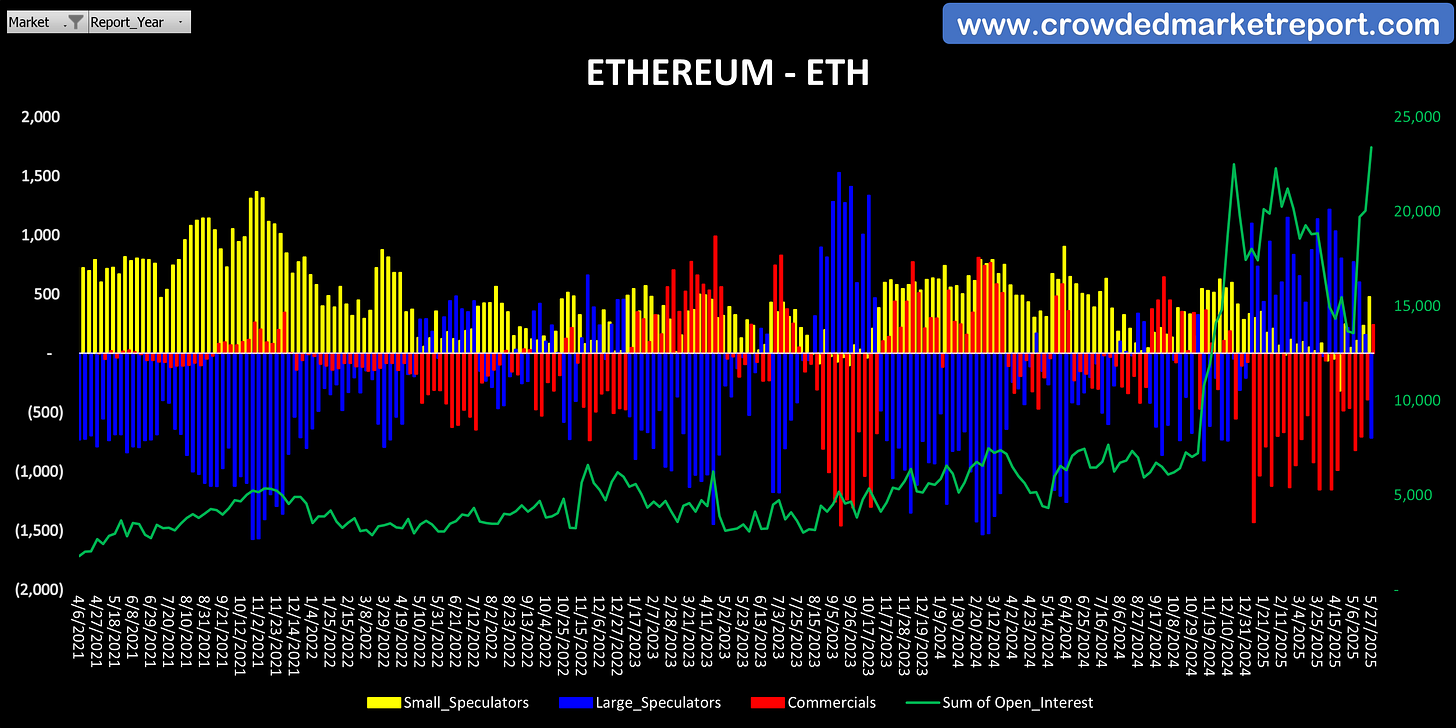

In this chart, which includes price and positioning, ETH had a good run in May and Large Speculators decided the rally was over. Will be see the same thing happen in ETH that happened in BTC? Time will tell, but fading this rally in ETH does not a give great reward/risk trade based on positioning. That does not mean it can’t go down, as ETH history is different than BTC where we see Large Speculators make some great trades shorting ETH in 2024. So far in 2025, that has not been the case, as they have been long the entire move down this year and just switched to net-short at the highest OI level in futures history for that contract.

It looks like large speculators are doubling down with recent info. Is the short term takeaway from this chart that large speculators have been on the wrong side of the trade and since they are net short now it behooves us to be on the opposing end? (long)